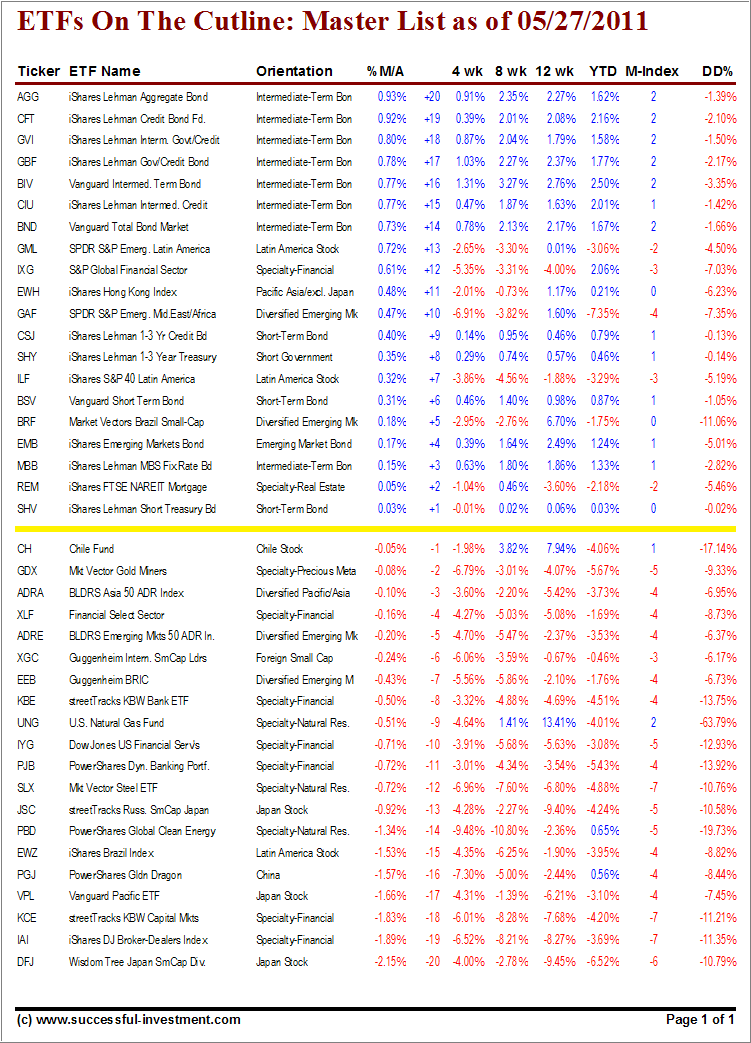

With the market’s early sell off, followed by a partial come back and a close to the downside, some of the equity ETFs around the cutline meandered as well with no convincing moves either way.

While weakness prevailed, the Latin American ETFs bucked the trend, came out of hibernation and did an about face, at least for this moment in time:

Latin America (GML) from -13 to +13

Latin America (ILF) from -17 to +7

Brazil (BRF) from -20 to +5

Slipping to the downside where the following:

Financial sector (XLF) from +10 to -4

China (PGJ) from +1 to -16

Diversified Emerging Markets (EEB) stayed below the line but improved from -19 to -7

Again, it’s important for me to point out that, as I posted in “How do I use the ETF Cutline Table to make a Buy decision,” just because an ETF rallies above its trend line, does not mean it’s a buy. If you missed it, take a look at the link for details on what to look for before making a decision.

Here’s this week’s report:

[Click on table to enlarge, copy and print]

The major indexes themselves are not showing any clear direction and are stuck in a trading range. Until there is a breakout, momentum figures in the cutline reports will remain weak.

If you are looking to deploy new money in those equity ETFs, which have just crossed their trend-line to the upside, this report shows that there are no new opportunities.

For quick reference:

ETF Cutline Post as of 5/20/2011

ETF Cutline Post as of 5/13/2011

ETF Cutline Post as of 5/6/2011

ETF Cutline Post as of 4/29/2011

ETF Cutline Post as of 4/21/2011

ETF Cutline Post as of 4/15/2011

ETF Cutline Post as of 4/8/2011

ETF Cutline Post as of 4/4/2011

Disclosure: No holdings in ETFs discussed

Contact Ulli