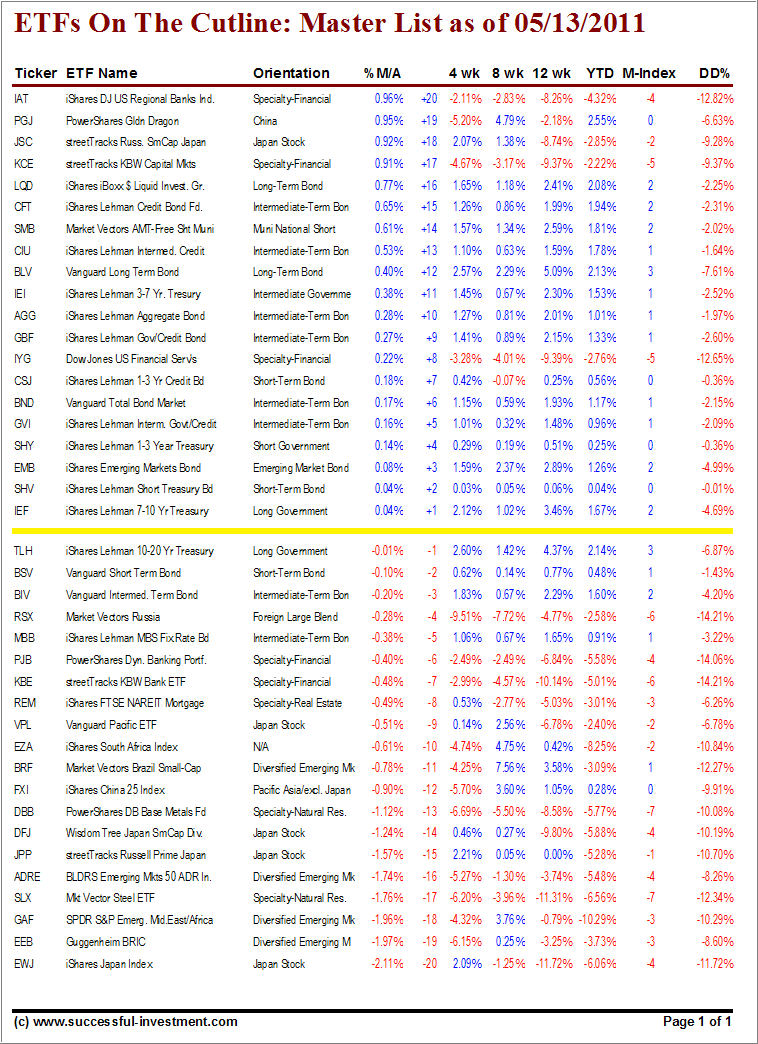

It was almost a repeat performance of the prior week as equities struggled to find some footing. There was more weakness in the international arena as compared to the domestic one, which is apparent by this latest Cutline report.

The few equity funds, within the 20 positions above the cutline (trend line), slipped and headed below the line. EWJ (Japan ETF) dropped the most and moved from +20 to -20. That was closely followed by EEB (Diversified emerging markets), which gave up its +17 position and ended up in the -19 spot. FXI (China) succumbed as well by moving from +19 to -12.

Bond ETFs held steady and EMB (Emerging Markets Bond) was the biggest gainer by moving from -7 to +3.

Let’s look at the table first, and then I’ll give you my interpretation for this week’s report.

[Click on table to enlarge, copy and print]

If you are looking to deploy new money in those equity ETFs, which have just crossed their trend-line to the upside, this report shows that there are no opportunities.

If more market weakness sets in, you will see additional equity ETFs appear on this list, but from a level above the +20, which is a sign of deteriorating momentum. Right now, it appears the best plan of action is to hold on to existing positions subject to my recommended trailing sell stop discipline.

For quick reference:

ETF Cutline Post as of 4/29/11

ETF Cutline Post as of 4/21/2011

ETF Cutline Post as of 4/15/2011

ETF Cutline Post as of 4/8/2011

ETF Cutline Post as of 4/4/2011

Disclosure: No holdings in ETFs discussed

Contact Ulli

Comments 4

I don’t get it. Why do none of funds meet buy criteria this week?

I see multiple funds with all positive momentum numbers and draw down under 2%. Why are they not buys? Is there some special drawdown % above which it is considered “high”?

Arby,

I was talking about equities, not bond ETFs.

Ulli…

Hi Ulli,

It’s a question:

I try to find a website with charts showing a total return for mutual fund or ETF.

Could you help me please.

Thank you,

mike

Mike,

Try Morningstar; I believe they show total returns.

Ulli…