Just last Sunday, I posed the question “Do Gold ETFs Still Have Legs?” Yesterday, it was answered—at least for the time being, as gold ETFs rallied into record territory.

While the equity markets went nowhere, precious metals had their day in the sun. My view has always been that known and unknown uncertainties will surface all of a sudden causing metals to react to the upside.

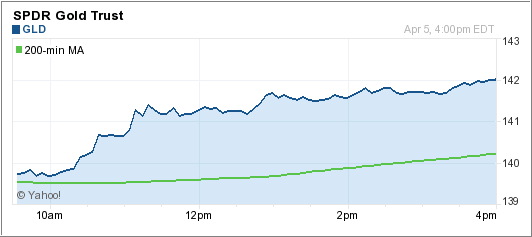

Yesterday was no exception; a variety of events kept a lid on any equity advances, while gold simply took off as the 1-day chart of GLD above shows.

First, there was the release of the Fed minutes from the March 15th meeting, which stoked fears of inflation among calls that it should be dealt with now rather than later. The effect would be higher interest rates, but concerns also surfaced that the labor market might be still too soft to absorb a boost in rates.

Second, continued global turmoil helped the cause for gold. Problems in the Middle East, fallout issues from the disaster in Japan and possible debt defaults in Europe combined to support the metals as a hedge against potential chaos.

That has been my point all along. There are more uncertainties in today’s world than we have seen in decades. None of these current issues will simply go away anytime soon. Actually, the dangers of unintended consequences flaring up somewhere seem to be increasing by the day.

While gold will not always have a smooth ride, it looks to be a great safety haven anytime world events hit a rough spot.

Disclosure: Holdings in GLD

Chart courtesy of YahooFinance

Contact Ulli