One of the most important aspects of trend tracking, or investing in ETFs in general, is to establish a position at the appropriate time.

Timing is everything not only in life but especially in the world of investing. If you have been reading this blog for a while and are following trends in the market place, you know that the crossing of a trend line to the upside, and into bullish territory, for any given ETF/mutual fund, represents the most appropriate moment to get into the market.

To be clear, just because a trend line crossing has occurred, it is by no means a guarantee that upward momentum will continue. However, your chances are greatly enhanced, and I believe the odds have increased in your favor, that a sentiment change from bearish to bullish has occurred. In other words, the trend line crossing is the proverbial line in the sand that divides bullish from bearish territory.

With some 500 ETFs in the ETF Master list of my data base, how can you track these constantly changing events quickly and effectively?

In the past you couldn’t but as of today, you can.

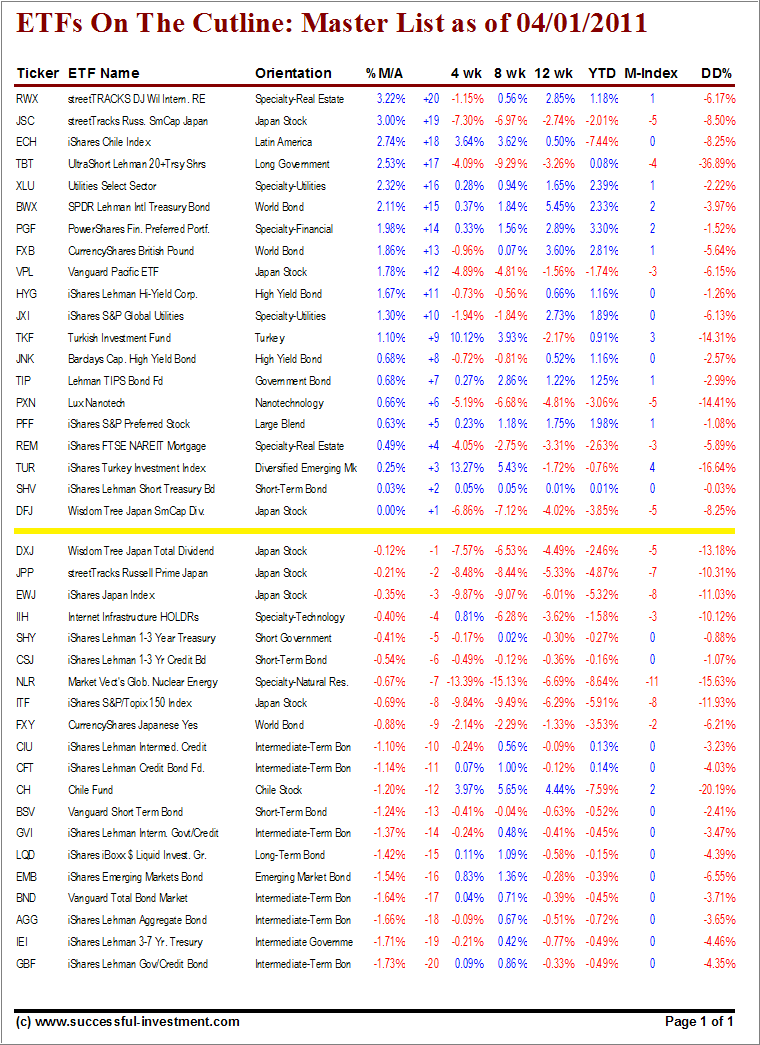

Introducing the first issue of a new post titled “ETFs On The Cutline,” which will be updated every Friday and posted on Saturday.

Take a look at the table below, which features only those ETFs hugging the cutline. The cutline is represented by the bold yellow line and simply shows which ETFs are currently within striking distance of breaking through to the upside and which ones have already made it or are on their way down.

Study the table for a moment:

[click on table to enlarge]If you have been reading my weekly StatSheet for a while, you should be familiar with all columns.

However, the %M/A (percentage of an ETF below or above its long term trend line) has been changed in the way it is sorted. Start at the cutline and notice that the first ETF above it is DFJ and the first below it is DXJ. To quickly follow their movement as time goes on, I have assigned a plus or minus number.

Therefore, DFJ, being the first ETF above the line, is identified by a placement number of +1, while DXJ, being the first ETF below the line, is identified by -1.

How do you use this data?

For example, last week I was tracking EWJ, which I had posted about, and it was in the -1 position. This week, it dropped to -3, which means it is meandering and did not have enough upward momentum to “make the cut.”

Just because an ETF has moved to +1 does not mean I will buy it. I like to see more upward movement before I pull the trigger.

Here’s the process I go through:

A few days ago, I wanted to add an income producing ETF to a client’s account. Looking at the cutline, I indentified several prospects that had clearly moved above it and displayed positive momentum numbers along with low DrawDown (DD%) percentages.

If you start at the yellow line and follow the plus numbers, you’ll find the first one that met my criteria to be PFF (+5), followed by TIP (+7), PGF (+14), BWX (+15) and XLU (+16). I eventually settled for XLU, but you get the idea.

Since the current bull market is now over 2 years old, you will not find many equity ETFs below the line. The value of this table will be over time as markets correct. Depending on the magnitude, you will be able to easily track those losing momentum and heading south below the cut line.

Once momentum changes back to the upside, you will be in a position to monitor upside breaks with ease using this table as ETFs move from negative placements to positive ones. That’s when the rubber meets the road, and you need to take action.

As you know, for broadly diversified domestic and international ETFs/no load funds, I use my respective Trend Tracking Indexes (TTIs) as an indicator to get into the market. However, all other areas like country, sector and bond ETFs require the use of their own respective trend lines. That’s where this table will be of great value to you.

Nevertheless, despite the signals of the TTIs, it pays to get a head start by knowing which ETFs have already shown strength by having moved above their trend lines and into bullish territory.

Using the right tools, such as this cutline table, will prove to be invaluable when it comes to making better and timelier investment decisions .

Contact Ulli

Comments 13

thanks!!!

I now understand. Thanks

Great idea, Ulli. It should prove to be a very useful tool!

Great Uli, many thanks!

Then we could put these trends and movements into a week by week diagram…?

I will provide a quick link every week to reference the previous week’s data.

Ulli…

Great!

You are one of my favoured website and you keep getting better!!

Many thanks.

thanks for sharing a valuable new tool we appreciate your continued hard work

Ulli,

This is awesome! I plan to use this extensively in my research. Also, what I think would be really cool is another column that shows the placement number ranking from a week ago alongside the current ranking. That would provide an easy way to track the week by week movement of the ETF as it moves among the ranks 🙂 Thoughts? Thanks! Michael

Michael,

While there is simply not enough room on one page to display 2 weeks of data, I will always provide a link referencing the info from the previous week. That should make it fairly easy to compare the two.

Ulli…

Ulli,

I am not sure I understand the %MA column exactly. I know that is the % above/below a Moving Average, but what is the duration of the moving average? As I recall your TTI trend line is 35 weeks or 175 days.

Thank you again for all of your information. It really gives me confidence in these shaky times.

Weems

All references to moving average are based on 39 week SMAs (Simple Moving Averages).

Ulli…

Ulli,

Thanks so much for all you do for everyone during these trying times in the world.

I really appreciate all you do !

Thanks so much !

Dina

Pingback: ETFs On The Cutline – Updated Through 06/19/2020 - Ulli... The ETF Bully