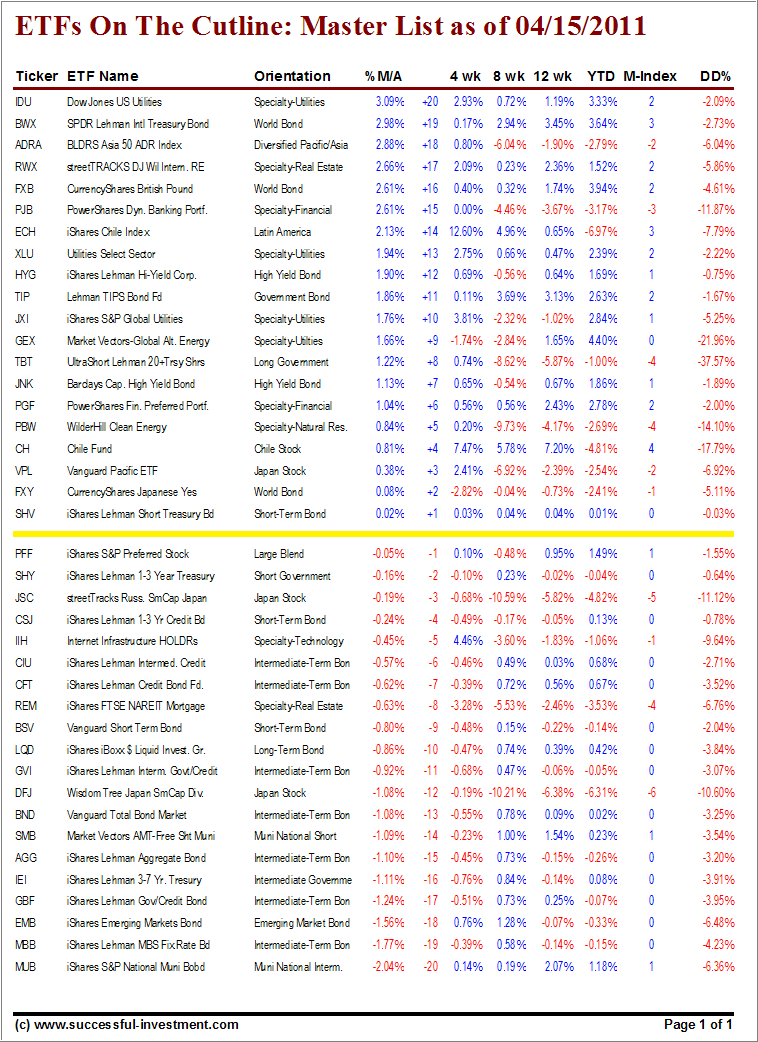

In this latest edition, you’ll notice again that ETFs do not remain in the same position in relation to the cutline for very long when market weakness sets in. For example, DFJ, which had a +1 placement last week, sold off sharply and ended up in the -12 position.

The lesson is that you need to have ETFs move above the cutline by a decent margin before considering them as a buy. Additionally, you want to make sure that all momentum numbers across are positive.

Take a look at this week’s table:

[Click on table for better viewing and printing]

The first ETF above the cutline this week that meets all criteria would be PGF; followed by TIP (we have no holdings in either).

If you purchased an ETF, and it slips below the cutline, should you sell it right away?

Personally, I don’t sell for the simple reason that I need to give this newly acquired position some room to move. I will apply my recommended trailing sell stop discipline and let the market tell me when it’s time to head for the exit door.

For quick reference:

ETF Cutline Post as of 4/8/2011

Contact Ulli