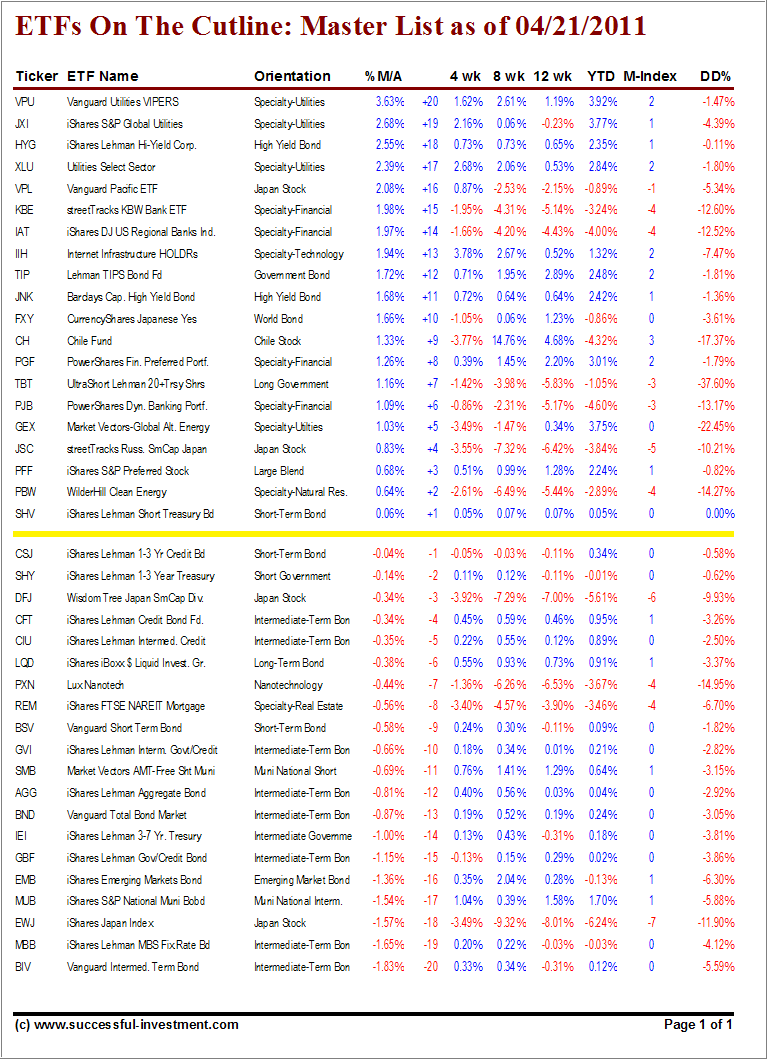

This week, you’ll notice again that ETFs do not remain in the same position in relation to the cutline for very long when market weakness or strength sets in. With the last few trading days having been bullish, some ETFs improved their positions.

Moving above the cutline to a +3 position from -1 last week, was PFF, which now also sports positive momentum numbers across the board, along with a low DrawDown percentage. Losing some momentum was PBW, which dropped from +5 to +2.

The lesson is that you need to have ETFs move above the cutline by a decent margin before considering them as a buy. Additionally, you want to make sure that all momentum numbers across are positive before taking a position.

Take a look at this week’s table:

For better viewing and printing, download the PDF: http://www.successful-investment.com/SSTables/ETFCutline042111.pdf

The first ETF above the cutline this week that meets all criteria would be PFF; followed by PGF.

If you purchased an ETF, and it slips below the cutline, should you sell it right away?

Personally, I don’t sell for the simple reason that I need to give this newly acquired position some room to move. I will apply my recommended trailing sell stop discipline and let the market tell me when it’s time to head for the exit door.

For quick reference:

ETF Cutline Post as of 4/15/2011

ETF Cutline Post as of 4/8/2011

Disclosure: No holdings in the ETFs discussed

Contact Ulli