- Moving the markets

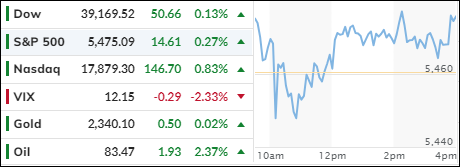

Wall Street’s optimism that the upcoming inflation numbers will be favorable for the markets carried over into today’s session, as the S&P 500 rose for a seventh straight day.

Economists expect the June CPI to advance 0.1% MoM and 3.1% YoY. The core CPI, which does no include food or energy prices, is predicted to have gained 0.2% MoM and 3.4% YoY.

So far, traders have simply ignored any economic downside risks, which have emerged recently, and have focused on hopes that the Fed will do whatever necessary and rescue the markets and the economy with a less restrictive policy.

Fed chair Powell helped the major indexes power higher when he emphasized what traders wanted to hear, namely that the bank won’t wait until the rate of US inflation slows to its 2% goal before cutting rates:

“If you waited that long you probably waited too long because inflation will be moving downward and would go well below 2%, which we don’t want.”

That’s all it took, and we ramped to a solid green close, not only in the tech sector but in the broad market as well. The Mag 7 stocks advanced for the 7th straight day as well as 10 out of the last 11.

Rumor had it that tomorrow’s CPI number had been leaked, which also may have underpinned today’s strong bullish sentiment. Rate-cut expectations rose, as bond yields more or less trod water.

The dollar slipped, gold headed higher but gave back some of its early gains later on. Oil prices surged but fell short of recapturing their $83 level, while Bitcoin rallied but ran into overhead resistance at its 200-day M/A.

Today’s strong session makes me ponder: Will the real CPI release tomorrow be a disappointment or a springboard for further advances?

Read More