- Moving the market

Last week’s selloff spread globally and accelerated this morning as traders grappled with fears of a U.S. recession. The downturn began in Japan, where the Nikkei plummeted over 12%, marking its worst day since the 1987 Black Monday crash. Contributing to the turmoil was Japan’s recent decision to hike interest rates, which disrupted the highly leveraged yen carry trade and triggered a cascade of selling and forced liquidations worldwide.

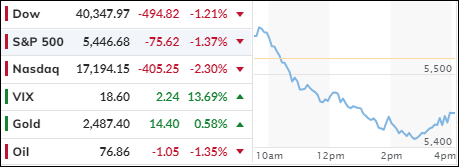

In the U.S., the Dow Jones Industrial Average dropped over 1,000 points, or 2.6%, while the Nasdaq fared even worse, losing 3.4%. The release of July’s jobs report on Friday exacerbated the situation, convincing traders that the Federal Reserve is behind the curve in cutting rates to address the current economic slowdown.

Mega-cap tech stocks were hit hardest, with Nvidia falling 6%, Apple 5%, and Tesla 4%. Broadcom and Super Micro also declined by 1% and 2.5%, respectively. Notably, only nine stocks in the S&P 500 ended the session higher.

At their lowest points, Small Caps and the Nasdaq were down 6% before dip buyers stepped in to limit the damage. The most shorted stocks were heavily impacted but managed to recover some ground late in the session.

The MAG7 stocks suffered significant losses, now down an astonishing $3 trillion from their record highs. The AI sector also faced a rapid decline, falling below its 200-day moving average. Bond yields were volatile, initially collapsing before rebounding to nearly unchanged levels.

The dollar weakened, crude oil retreated but later recovered, and gold experienced wild swings before bouncing off support. Bitcoin also took a dive as traders liquidate assets to meet margin calls, but it found support at the $50,000 level.

In my advisory practice, we sold a major tech ETF and closed our position in the international market after the International TTI dropped below its long-term trend line.

The future direction of the market now hinges on the Federal Reserve’s response.

Will they panic and implement an emergency rate cut to prevent equities from plunging further?

Read More