- Moving the market

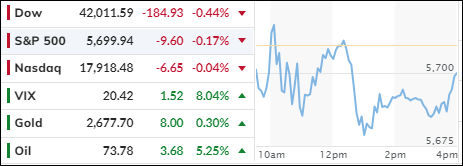

The financial markets were significantly impacted by climbing bond yields and surging oil prices, which drove the major indexes down throughout the session.

The 10-year yield rose above the 4% mark for the first time since August, rebounding from a low of 3.60% in September. This sharp increase comes despite the Federal Reserve’s efforts to lower rates.

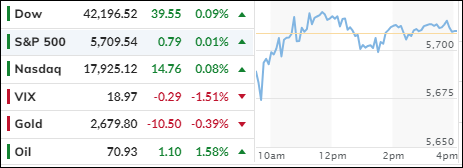

Last week was turbulent, with only modest gains for the averages. However, a better-than-expected jobs report, at least in terms of the headline number, has led traders to believe that the Fed might achieve a soft landing for the economy.

While this outcome remains uncertain, the long-term trend is still upward, and we plan to stay the course until it changes. The Fed’s minutes from its last meeting will be released on Wednesday, followed by the Consumer Price Index (CPI) report on Thursday.

Expectations for rate cuts plummeted, causing all major indexes to decline. The MAG7 basket was also affected by Google’s weakness due to an app store injunction requiring them to open their app store to competition.

The most shorted stocks fell, erasing Friday’s gains. Bond yields surged further, with both the 2-year and 10-year yields piercing the 4% level. Interestingly, the dollar remained stable, and gold stayed within its recent trading range.

Bitcoin exhibited volatility, rallying, and then receding twice, influenced by the Google headlines.

Meanwhile, the risk of a U.S. foreign default continues to rise.

Read More