- Moving the Markets

The major indexes managed to shake off yesterday’s pullback, which marked the day of the Fed’s second hike in interest rates in almost 10 years. While this was widely expected, I thought the markets would have taken that removal of uncertainty as a positive, but Yellen spoiled the party with her announcement that she anticipates three more hikes in 2017. Hmm, 4 rate hikes were promised for 2016 and only “one” materialized…

Interest rates continued to soar with the 10-year Treasury yield now reaching 2.60% from a July 2016 low of 1.37%. That is a huge move and, if we get close to the 3% milestone, there will be some fallout in the stock market as well.

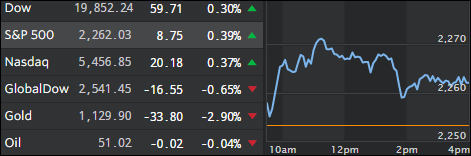

Take a look at the graph below where I have charted the S&P 500 vs. the 10-year Treasury bond: