- Moving the Markets

It was another non-eventful day in the markets with the Dow and S&P inching lower, however, the Nasdaq managed to eked out a new high. While earnings reports have been holding up, the spanking being dished out almost daily in the oil market along with opinions from the various Fed mouthpieces kept the markets in a tight trading range.

For sure, a new catalyst is needed to push markets higher, although these days just the absence of bad news could be enough to send the indexes nibbling at new all-time highs. However, given the almost daily load of deteriorating economic fundamentals, the odds are increasing that eventually gravity will take over and pull the indexes off their lofty levels down to a point that represents reality, which has been sorely lacking.

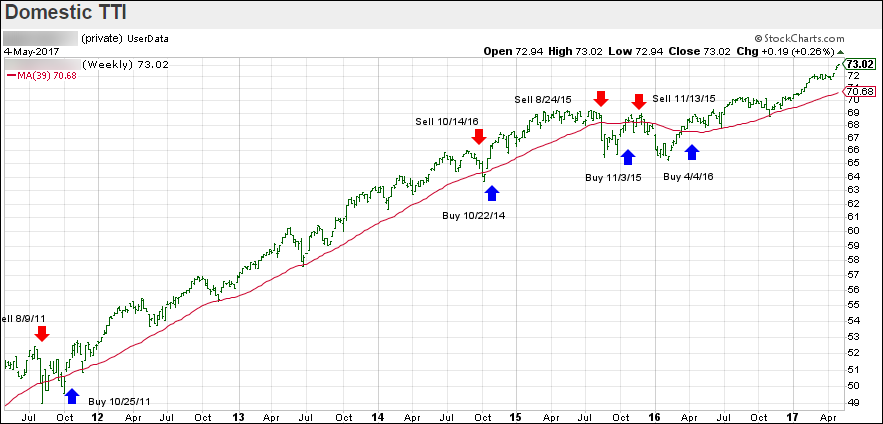

Has upside momentum started to slow down? It depends what indicators you look at. Our Trend Tracking Indexes (TTIs) represent the big long-term picture, and they are firmly entrenched on the bullish side of their respective trend lines. Of course, I am always looking for the canary in the coalmine that might give me some short-term indication of waning momentum.

One of those short-term indicators in regards to the S&P 500 is the change in the number of companies above their 50-day and 200-day moving averages. Take a look at this 6-month chart: