ETF Tracker StatSheet

https://theetfbully.com/2017/05/weekly-statsheet-etf-tracker-newsletter-updated-05112017/

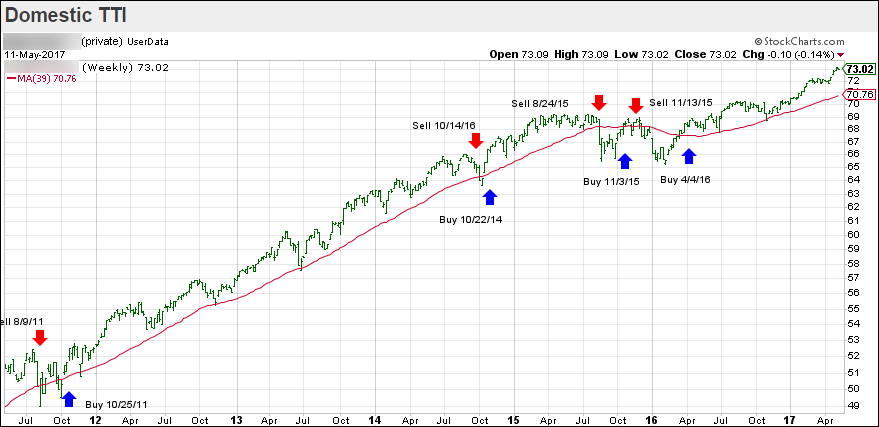

ECONOMIC DATA POINTS CONTINUE TO WEAKEN

[Chart courtesy of MarketWatch.com]

- Moving the Markets

The low volatility environment continued as the VIX extended its steak of closing below 11 for 15 consecutive days thereby smashing the previous record. As a result, the major indexes moved in a narrow range, mostly below the unchanged line, appearing to bounce off a glass ceiling all week long.

Equities, with the exception of the Nasdaq, ended in the red for the week with the S&P 500 losing 9 points or -0.33%, a move that is hardly worth mentioning. The retail massacre continued as retail sales missed across the board summarized as follows:

- Retail Sales up 0.4%, missing expectations of +0.6%, up from an upward revised 0.1%

- Retail sales up 4.5% Y/Y, down from 5.2% in April

- Retail sales less autos rose 0.3% in April, est. 0.5%, unchanged from last month’s revised 0.3%

- Retail sales ex-auto dealers, building materials and gasoline stations rose 0.2% in April

- Retail sales ‘control group’ rose 0.2% m/m in April

Source: ZH

Financials were the loser over the last 5 trading days, but tech performed well with the FAANGs (Facebook, Amazon, Apple, Netflix, Google) taking top billing and accounting for most of the gains. Translated, it means that these 5 stocks gained in market cap while the remaining stocks in the S&P 500 ended in the red. Ouch!

US Macro data has now collapsed for the 8th straight week and has decoupled from reality in similar fashion as it did in 2015. Take a look at these charts and see how that ended up:

Read More