- Moving the Markets

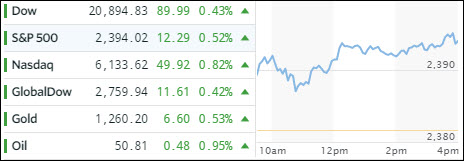

After the break through the glass ceiling yesterday, the major indexes managed to maintain upward momentum to score gains for the 6th consecutive day recovering all losses sustained during last week’s dump. While the Dow lagged, the S&P and Nasdaq shot up into record territory.

Stocks still felt good the morning after digesting the Fed minutes, disregarding the warnings, and focusing on the hope that Fed members are basically in agreement that there will be a “very gradual and thoughtful balance sheet normalization process.” Some good earnings gave an assist as well.

All this good mojo was enough to push equities higher, which helped traders to simply ignore some bad news, namely that crude oil got spanked at the tune of -5.16% pushing the black gold solidly below the psychologically important $50 level to close at $48.71.

With so much green on the board, bonds joined in and rallied with the 20-year Treasury TLT gaining a tad. The US dollar showed signs of life again with UUP adding +0.12%, and precious metals closed higher as well. Even the VIX, which usually moves opposite of the S&P 500, decided it must be opposite day and edged higher.