- Moving the markets

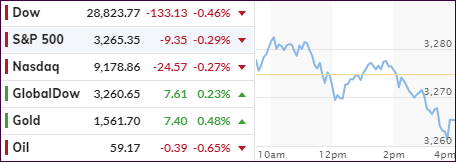

The bullish mood continued with the S&P and Nasdaq setting new records, while the Dow briefly crossed its 29k marker but backed off later in the session.

Supporting the ramp higher was news that the U.S. no longer plans on designating China a currency manipulator, which is mainly a symbolic designation but was also seen as a good will gesture.

That further seems to soothe the always raw nerves in the US-China trade battle, which are scheduled to be signed this Wednesday, although it will only be a Phase-1 settlement with other negotiations to follow with the goal to eventually achieve a full resolution.

With the earnings season on deck, rumors circulated that, once world’s largest investment banks show their report cards, some of the details (fixed income) may not be as bad as feared, which lent support to today’s advance.

Taking top billing today was the Nasdaq with a +1.04% gain, while the S&P settled for 2nd place with a nice showing of +0.7%, a good chunk of which came during the last hour push, as we have witnessed many times in the past.

All eyes are now on tomorrow’s start of the financial earnings reporting cycle, which may very well give a hint as to what else is to come.

Read More