- Moving the market

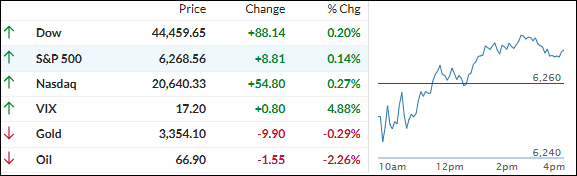

The S&P 500 got off to a hot start, thanks to a 6.5% surge in Nvidia, which pushed the index to a fresh record above 6,300. But that early momentum didn’t last—by the end of the day, the S&P had slipped into the red.

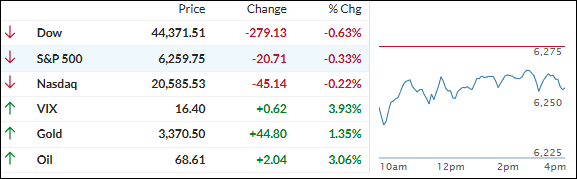

The big event of the day was the June CPI report. Inflation rose 0.3% for the month, putting the annual rate at 2.7%. That’s exactly what economists expected. Core CPI (which strips out energy) came in at 2.9% year-over-year—again, right on target. But here’s the catch: both numbers were up from May, and that uptick was enough to spook traders.

So, while the data didn’t surprise on paper, the market didn’t love the direction it was heading. The Nasdaq managed to hang onto some gains, but the rest of the market faded fast.

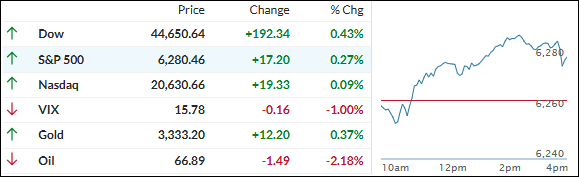

Bank earnings were a mixed bag, and while investors are still hopeful that Q2 results will give the market a lift, today’s action didn’t offer much encouragement.

Rate cut hopes took a hit too. Tariff data showed price increases in categories like furniture, apparel, and auto parts—fueling concerns that inflation might stick around longer than expected.

Tech stocks, especially the “Magnificent 7,” were the stars of the day. But outside of that group, the broader market got smacked around. An early short squeeze fizzled out, and with it, any bullish vibes.

The U.S. dollar had a strong day, rising 0.56% as bond yields jumped. That put pressure on gold, which dipped but found some footing at its 50-day moving average.

Bitcoin also took a breather after hitting new highs yesterday. The drop came as the House failed to pass a procedural vote on three crypto bills expected this week.

And then there’s Nvidia—again. The chip giant soared over 6% on news of strong China sales, pushing its market cap past $4.2 trillion. Not bad for a day’s work.

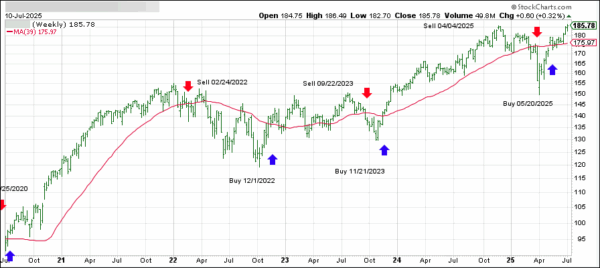

So, the big question is: with markets near all-time highs and inflation still lurking, how much more upside is left?

Read More