ETF Tracker StatSheet

You can view the latest version here.

SURGING BOND YIELDS SPANK EQUITIES

- Moving the markets

After yesterday’s modest bounce of hope, traders and algos alike were hit with another reality check, namely the fact that the Fed’s preferred measurement of inflation, the PCE (Personal Consumption Expenditures Price Index) rose 0.6% in January and 4.7% YoY.

That exceeded market expectations and, when combined with personal spending having soared by 1.8%, which was not only above hopes of 1.4%, but also the biggest leap since March 2021, you have a recipe for market chaos.

That’s exactly what we got, as the Dow dumped some 470 points early on, but that deficit was reduced a little as dip buyers could not resist and nibbled at those bottom prices. Still, to me these numbers merely represent just another nail in the “pause or pivot” agenda, as the theme, that the Fed might suddenly turn dovish, is merely a vanishing point in the rearview mirror.

In econ news, we learned that inflation expectations rose in February, as did the Citi Economic Surprise Index. New Home Sales unexpectedly soared in January, while prices plunged.

As a result, the Fed’s terminal rate propelled to a new high, as the hope for rate cuts disappeared, which is a sign that recent receding inflation numbers were nothing but transitory, and that we may now see again an increase in prices.

Bond yields were higher during this Holiday shortened week, with the US Dollar continuing its upswing, which now has erased all of January’s losses, a trend that was not beneficial for Gold, which, however, has managed to defend its $1,800 level.

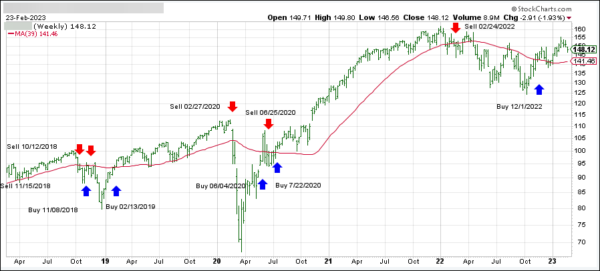

For the month of February, the S&P 500 has surrendered 2.6% so far, with two trading days to go. While our Trend Tracking Indexes (TTIs-section 3) have weakened as well, they still remain on the bullish side of their respective trend lines.

However, should the inflation scenario worsen, and consequently bond yields surging even higher, we must be prepared to deal with a potential sell signal in equities. For sure, I am ready to pull the trigger, if a major change in market direction necessitates such a move.

Read More