- Moving the markets

As expected, the Fed raised their interest rate by 0.25%, but traders were more interested in the accompanying statement, and that’s where the disappointment came in.

The statement was a hawkish pause, which signaled that “some additional policy firming may be appropriate,” as opposed to what traders had hoped for, namely “some additional policy easing may be appropriate.”

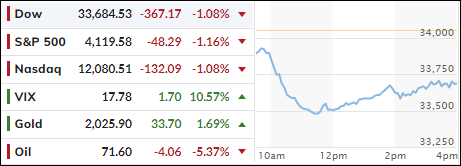

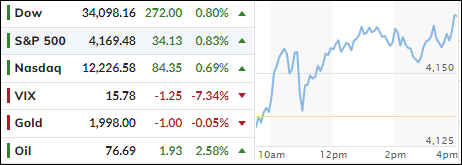

For a while, confusion reigned, as Wall Street came to grips with what was said, and how it could be interpreted, with the major indexes chopping up and down (see chart above), before the bears stepped in and took the upper hand.

Former chair Richard Clarida summed up best the tight spot the Fed finds itself in:

The chair will have his work cut out for him because when the chair will say ‘pause,’ the markets may hear ‘done.’ And if he says it again, they may hear ‘rate cuts.’

And that’s exactly how the market has reacted over the past year, in that Powell’s words were ignored in favor of what the markets wanted to hear.

In the meantime, the banking crisis goes on, and it remains to be seen how many of the 4,000 banks will follow the same downward path. You may not think that the 3 banks that failed so far are a big deal, but they are when compared to the events of 2008.

All three had more assets ($549 billion) than all 25 banks ($374 billion) that collapsed in 2008. That is a sobering statistic, and should the domino effect continue, which I believe it will, equities will be severely affected.

The Regional banks took another hit, after Powell announced that the banking system was sound and resilient. Huh? Bond yields tumbled, with the 2-year again losing its 4% level.

The US Dollar tanked and reached 2-week lows, which was a benefit for Gold, as the precious metal solidified its position above the $2k level.

Read More