ETF Tracker StatSheet

You can view the latest version here.

OCTOBER SURPRISE: STOCKS RALLY AMID TRADE TRUCE AND TECH REBOUND

- Moving the market

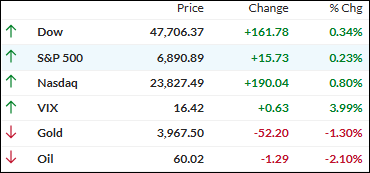

Stocks kicked off this session with a bang, especially the Nasdaq, thanks to some impressive earnings from Amazon. The tech giant’s shares jumped 10% after it reported a 20% revenue boost in its cloud division—well above Wall Street’s expectations.

Netflix also made headlines, climbing 3% after announcing a 10-for-1 stock split, which tends to attract more retail investors.

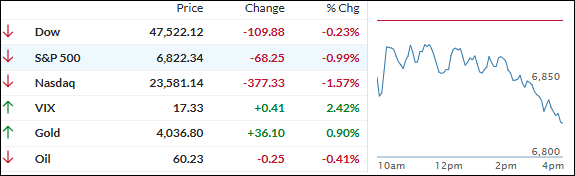

This rally came after a rough Thursday, when major tech names like Meta, Microsoft, and Nvidia dragged the market down. Meta suffered its worst single-day drop in three years, as investors grew uneasy about ballooning AI-related expenses.

On the geopolitical front, a bit of relief: Presidents Trump and Xi agreed to a one-year trade truce during their meeting in South Korea, easing fears of a full-blown trade war.

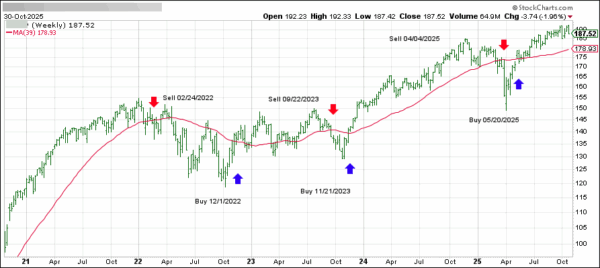

Despite some weak macro data earlier in the month, October wrapped up on a surprisingly strong note.

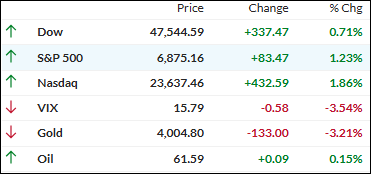

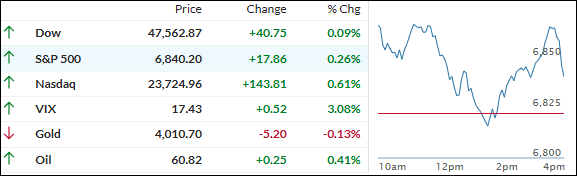

The S&P 500 rose 2.3%, and the Dow notched its sixth straight monthly gain—a streak we haven’t seen since 2018. Most of the strength came from tech, with the “Magnificent Seven” outperforming the broader market.

Bond yields were all over the place but ended lower, as expectations for a December rate cut faded. The dollar posted only its second monthly gain this year, while gold and silver both rallied—up 3.6% and 3.9%, respectively.

Bitcoin hit a record high early in the month but then drifted sideways, holding steady around the $110k mark.

So, despite a month light on economic data, markets managed to dodge the usual October volatility and closed out in the green.

The big question now is: Can this momentum carry us through the strongest seasonal stretch of the year—or did we just burn through the good vibes too early?

Read More