- Moving the markets

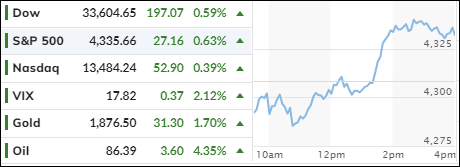

Stocks went up on Wednesday as investors shrugged off the latest inflation scare and celebrated a big deal in the oil industry (Exxon swallowed Pioneer Natural Resources).

Treasury yields kept falling from the 16-year peaks they hit last week, which gave stocks a boost after a midday slump. Another factor that helped stocks bounce back was the easing of financial conditions in the past few days, as the Middle East turmoil sent investors running for the safety of bonds.

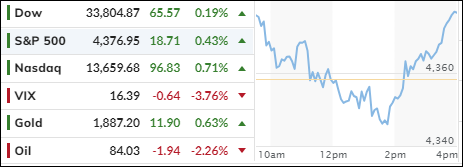

I wonder if some hawkish Fed officials will show up soon and talk rates back up again. The producer price index (PPI) climbed 0.5% in September, beating the forecast of 0.3%. This pushed the headline number up by 2.2% year-over-year. That’s the highest annual increase since April 2023 and the third month in a row, as food prices soared to levels not seen since November 2022.

The 10-year Treasury yield dropped even after the hotter-than-expected inflation data, reaching its lowest point since Sept. 29. The 10-year shed more than 9 basis points to 4.569%.

If bond yields keep going down despite rising inflation, I think that will be the main reason for a decent recovery in the stock market. But it all depends on how bad the inflation numbers get.

Tomorrow’s CPI may give us a better idea of where we’re headed. Yesterday’s short squeeze was nowhere to be seen today, the dollar was steady, crude oil cooled off, and gold kept climbing to hit two-week highs.

Minutes from the Fed’s latest meeting due later today will reveal more about the central bank’s plans for raising interest rates after it decided to skip a hike last month.

And tomorrow, it will be all about the CPI which, if worse than expected, could wake bond yields from their dovish nap.

Will inflation keep spooking the markets or will bond yields come to the rescue?

Read More