- Moving the market

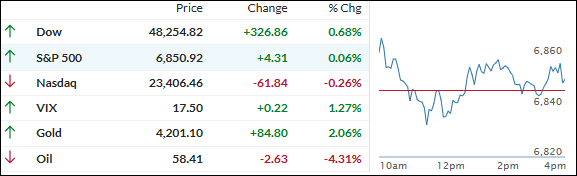

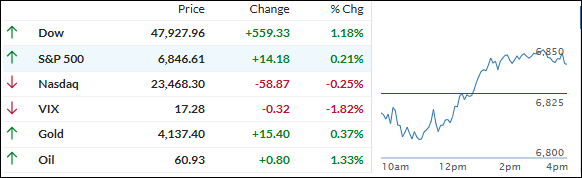

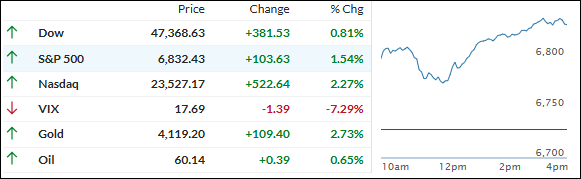

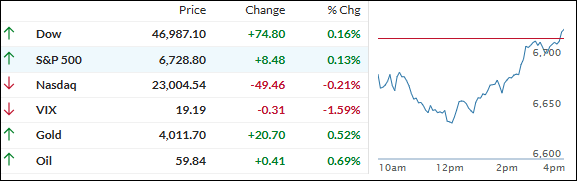

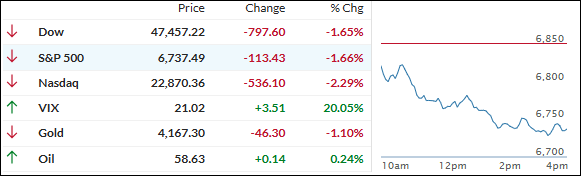

Today was the classic “buy the rumor, sell the fact” type of session: markets opened lower and just kept sliding, even as the long-awaited government re-opening failed to inspire the bulls.

Tech and AI names took the brunt of the selling, with the Nasdaq locking in its third straight decline, led down by heavyweights like Nvidia, Broadcom, and Alphabet.

This week’s action shows a clear split—while health care and other value sectors managed to hold up earlier in the week, today everything went south, partly because traders were left flying blind with no new jobs or inflation data following the extended government pause.

The lack of fresh economic reports left everyone guessing about the Fed’s next move and increased anxiety about the rate outlook.

AI favorites in the Mag 7 basket got whacked for a third straight day, while rising bond yields and a sliding dollar couldn’t keep gold shining; even the precious metal dipped, though not nearly as much as stocks, and remains solidly up year-to-date.

Bitcoin lost its $100k handle before bouncing at $107k.

Is this growing caution just a temporary blip, or does it mark a shift to a rougher, more uncertain market as year-end approaches?

Read More