ETF/Mutual Fund Data updated through Thursday, May 19, 2011

If you are not familiar with some of the terminology used, please see the Glossary of Terms.

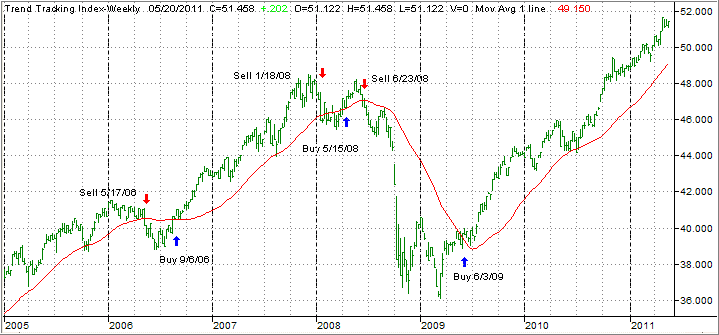

1. DOMESTIC EQUITY MUTUAL FUNDS/ETFs: BUY— since 6/3/2009

As announced via a blog post, on 6/2/2009, the TTI triggered a buy signal with an effective date of 6/3/2009. We will use the 7% trailing stop loss of our positions as an exit point or the crossing of the trend line to the downside, whichever occurs first.

As of today, our Trend Tracking Index (TTI—green line in above chart) has broken above its long term trend line (red) by +4.99%.