ETF/No Load Fund Tracker For Friday, June 10, 2011

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, June 10, 2011

MAJOR MARKET ETFs IN RETREAT – NO PLACE TO HIDE

The market’s stumble into June continued all week and was only interrupted by a short pause on Thursday, when a rebound attempt gave the bulls some hope. Other than that, the bears had a firm grip on broad downward momentum.

Global growth worries were brought back to center stage when China reported a smaller-than-expected trade surplus indicating a slow down. In Britain, industrial production took a turn for the worse when no change had been expected. Add to that the ever continuing debt soap opera in Europe, and you have a condition that is simply not supportive of rising equity prices.

The question remains if the major indexes can find some support before we actually slip into bear market territory. Looking at some widely followed indicators, we are getting close to a directional change.

The benchmark S&P 500 has reached a point that is within 0.64% of breaking its widely followed 200-day moving average. The Dow Jones Transportation index is equally weak and has come within 0.01% of breaking its respective trend line.

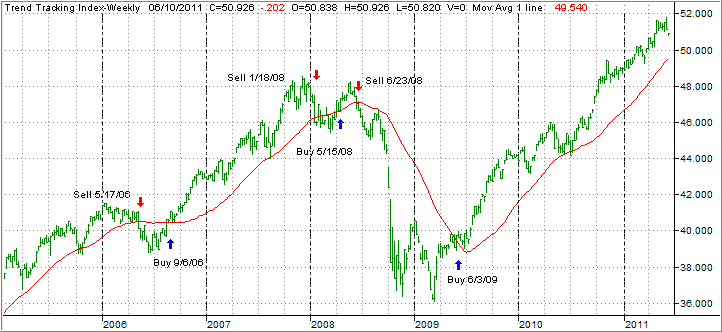

Our Trend Tracking Indexes (TTIs) are showing similar slippage as well as a divided picture:

Domestic TTTI: +2.16% (last week +3.46%)

International TTI: -0.70% (last week +1.67%)

Yes, the international TTI actually broke below its long-term trend line today, although by only a small percentage. In order to avoid a whip-saw signal, I will watch market activity for a couple of trading days, before issuing a Sell signal for that arena, since this indicator tends to be more volatile than its domestic cousin.

The S&P 500 is now barely hanging on to a 1% gain YTD, while our ETF Model Portfolios have fared far better, as I had expected, with the Aggressive Growth (#3) and Trend Tracking Portfolios (#1) leading the pack as of today with +4.33% and +3.98% respectively.

This current U.S. economic soft patch appears to be hardening, which may very well cause this bull market to die a slow death. Now that all stimulus attempts have been wasted, we will see what is left of the real economy.

How low can we go? Some technical analysts are seeing major buying support for the S&P 500 at around the 1,250 level, which would be below its 200-day moving average of 1,259. I for one will not wait to see if buyers actually show up, should we sink to that level from the current 1,271 close.

Sell stop wise, not too much happened today, although several mutual funds broke below their predetermined sell point. On the ETF side, only VEU (from our current holdings) slipped below and will be sold on Monday, unless a solid rebound emerges.

This is the time when the rubber meets the road, and you have to be alert to changes in major market direction. While there is always the chance of a dead cat bounce, such as we saw Thursday, the odds have clearly increased that more weakness will be with us.

At the risk of sounding like a broken record, monitor your sell stops and execute them when they reached their predetermined levels. Even if you follow the fundamentals, you have to admit that there are not too many arguments right this moment for much higher stock prices.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Kent:

Q: Ulli: What isn’t clear is what happens to the money from the funds that are sold in the ETF Model Portfolios? I noticed cash percentages appear to be the same as last week, in those portfolios where funds have been sold. If you get a chance, please clarify. Thanks!

A: Kent: Yes, I don’t really change the cash positions, since that is too cumbersome. I still show the sold positions with their value at the time of sale, but crossed out. I use that as a base for reinvestment whenever that time comes. That’s the theme I followed when I reinvested in XLV.

You are very observant!

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at: