ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

https://theetfbully.com/2011/06/weekly-statsheet-for-the-etfno-load-fund-tracker-updated-through-6232011/

————————————————————

Market Commentary

Friday, June 24, 2011

ETFs HAULING SOUTH

Yesterday’s late rebound, following an early morning sharp selloff, gave the bulls some hope that the bad news out of Greece, as well as economic worries, was a bit overblown.

Today, the opposite happened, as an early morning rally succumbed with the major indexes closing near their lows for the day. It seemed that with so much global uncertainly, traders did not want to hold on to any long positions over the weekend.

That is probably not a bad idea considering that a new elephant of Italian descent suddenly showed up in the room. While debt troubles with Greece are well documented daily, the fact that the Italian banks stepped on the on-deck circle was a surprise and created a bit of market anxiety. At issue is the financial health of several major players with Moody’s threatening to downgrade 13 of them.

Domestically, adding to the sour mood were tech heavyweights Oracle and Micron, which were a drag as a result of reduced sales (Oracle) and lower than expected profits (Micron). On the slightly positive side were an upward revised 1st quarter GDP number of 1.9% and growth in durable goods orders in May after a decline in April.

While the market drop from last Friday’s close was only minor, we have now reached and closed right at the S&P 500’s 200-day moving average. Several times this week, that level has served as support and propelled the markets higher.

However, repeated testing of support levels tends not to end well. With turbulent news from the far corners of the world becoming a daily occurrence, it will not take much downward momentum to not only break but also close below this level. With many technicians considering this point the dividing line between bullish and bearish territory, more selling is virtually a guarantee once that level gives.

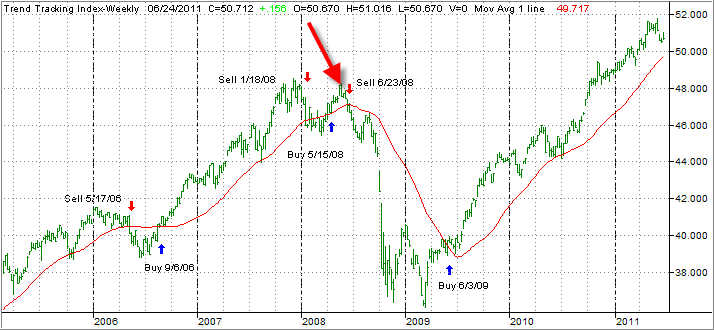

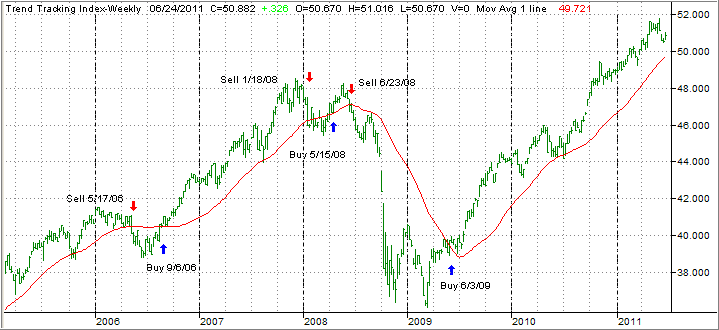

Our Trend Tracking Indexes (TTIs) have followed the ups and downs during this past week and are now positioned as follows:

Domestic TTTI: +2.02% (last week +1.87%)

International TTI: -2.04% (last week -1.69%)

Of course, it is entirely possible that the S&P’s 200-day moving average will shine again by attracting enough buyers next week to push the indexes back into orbit, but I doubt that this would be a lasting situation. From my view, there are simply too many headwinds to support the bullish case for any length of time.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Ron:

Q: Ulli: Starting to use your model portfolios! Do I assume that those positions you show as holds are still currently buys?

Thanks and have a great day!

A: Ron: The positions shown as “hold” are referring to the sell stops not to the portfolios themselves. Personally, I have been holding back deploying new money due to the recent sell off. I am looking to ease into PRPFX but have no plans, given current momentum numbers, to add any of the ETFs listed.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Recently, the WSJ (subscription required) featured a piece with the title “Unstable Condition.” Let’s look at a few highlights:

Recently, the WSJ (subscription required) featured a piece with the title “Unstable Condition.” Let’s look at a few highlights: