ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

https://theetfbully.com/2011/06/weekly-statsheet-for-the-etfno-load-fund-tracker-updated-through-6302011/

————————————————————

Market Commentary

Friday, July 1, 2011

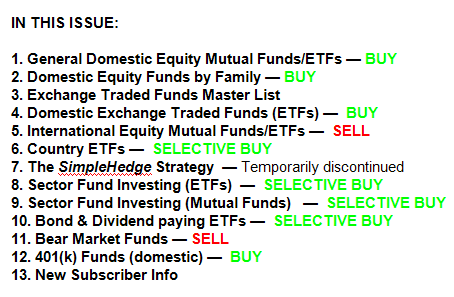

SERIOUS BULLS—MAJOR MARKET ETFS ON THE RUN

No question about it, the bulls had it their way this past week, as positive interpretations of current events gave the bears no chance other than to retreat.

The major market ETFs were up every day this week supported by bargain hunting, while traders were downright euphoric about the temporary debt solution in Greece, including new austerity measures, even though long-term nothing has been resolved. But hey, traders are living for the moment, so who cares about issues that are not on the menu right now?

Amazingly, poor economic data, such as a mixed report on home prices and slipping consumer confidence, which surfaced throughout the week, were simply ignored or overlooked. Of course, technically speaking, some of this rebound can be attributed to an oversold condition along with end of the quarter window dressing.

The markets showed a weak performance in June, as well as the last quarter, with the major indexes having fallen in seven out of the last eight weeks, so we bounced back from an oversold condition.

Supporting the bullish case were a positive Chicago PMI report, which raised hopes that the economic soft patch could be nearing an end. Supporting that view, and fueling the rally, was today’s June manufacturing report, which rose and beat analysts’ expectations.

While market euphoria makes everyone feel good, it does not mean the bullish trend will continue. A few items of caution are that this rebound occurred on light volume making it questionable as to whether there is substance behind it. We will find out more next week.

Second, the debt ceiling issue has not been resolved and could affect market direction. Third, the Fed’s Quantitative Easing Program (QE-2) is over, but the effect on the bond market is still unknown.

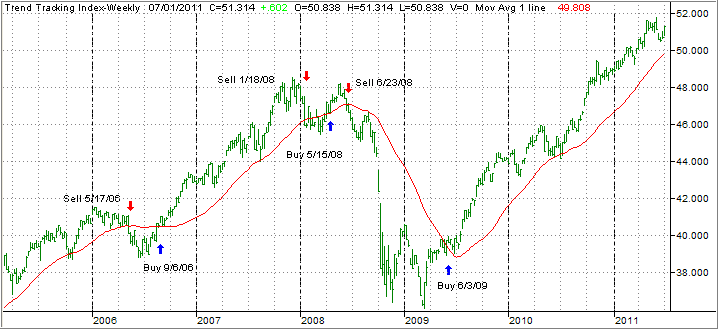

Our Trend Tracking Indexes (TTIs) rallied with the market and have reached the following position relative to their respective long-term trend lines:

Domestic TTI: +3.67% (last week +2.02%)

International TTI: +1.72% (last week -2.04%)

(Please note that the TTIs are estimated due to not all data being available at the time of publication)

As you can see, our international TTI has come out of bear market territory and broken out to the upside again. After its recent ‘Sell’ signal, effective 6/16/11, I will wait another couple of trading days to make sure this index remains firmly entrenched above its trend line before issuing a new ‘Buy.’ If that materializes, I will post it to the blog.

Next week seems far away as a long 4th of July weekend is ahead of us. I will be traveling, so my blog posts will be on the skinny side this weekend.

Have a great week and Happy 4th of July!

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Don:

Q: Ulli: I’ve been a follower of your Successful-Investment updates for some time. I enjoy looking at your various portfolios you started sending out last April. I do wonder though about some of your sell decisions and thus have a few questions.

1. It appears a trigger of -7% does not always automatically generate a sell. It appears you look at the next day to see where the ETF moves after the opening and then decide whether to hold or sell. I observed several triggers that recovered the following day, yet you may have to actually follow the ETF that day to make a decision. Thus, is the decision mechanical or is it subjective to watching the following day’s pricing of the ETF, thus being almost in the mode of a day trader?

2. Some triggers of -7% however, were also below the trigger the following day, so why didn’t you sell this second day? Are you thus being subjective or have some other objective reason for not selling?

Examples:

ETF: VB, trigger on 6/6, sold on 6/7 — okay using next day sell after a trigger.

ETF: VEU, trigger on 6/10, sold on 6/13 — okay using next day sell after a trigger.

ETF: VWO, trigger on 6/15, didn’t sell on 6/16, waiting until 6/17?? — Why another day?

Earlier sell for VWO: signal on 02/22, didn’t sell on 02/23 — why wait two days when

other sells are the day after if they didn’t recover? Seems like VWO should have been sold on the 2/23.

All things considered, you are doing a great service for the ETF Investor — keep this going.

A: Don: To your sell stop questions. You are correct with all, except VWO. Remember, I use different percentages. For “broadly diversified domestic and international funds/ETFs,” I use 7%. For more volatile sector and country funds/ETFs, I use 10%. VWO falls under the category of country funds.

However, VWO did not reach its 10% level, but dropped below its long-term trend line (%M/A column) first, which supersedes its sell stop. It happens so rarely, which is why it hasn’t come up in discussions. Most of the time, our sell stops get triggered before the respective trend line gets crossed!

Hope this answers it.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/