ETF/No Load Fund Tracker For Friday, July 22, 2011

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

https://theetfbully.com/2011/07/weekly-statsheet-for-the-etfno-load-fund-tracker-updated-through-7212011/

————————————————————

Market Commentary

Friday, July 22, 2011

MAJOR MARKET ETFs BUNGEE-JUMP BACK

After losing 2.1% the prior week, the major market ETFs shifted into rally mode with the S&P 500 gaining 2.2%, which brings us back to the level from 2 weeks ago.

This past Tuesday, the markets received an assist from Apple’s blowout earnings and a new Senate budget plan. Upward momentum picked up stream again on Thursday, when more talk of debt solutions in the U.S. and Europe, along with a big health care merger, provided the necessary ammunition.

In the end, no real solutions to the debt issues that ail the world were found, but the markets managed to hang on to its gains so far. Back on the front burner domestically was the continued jawboning about the nation’s debt limit with no tangible results.

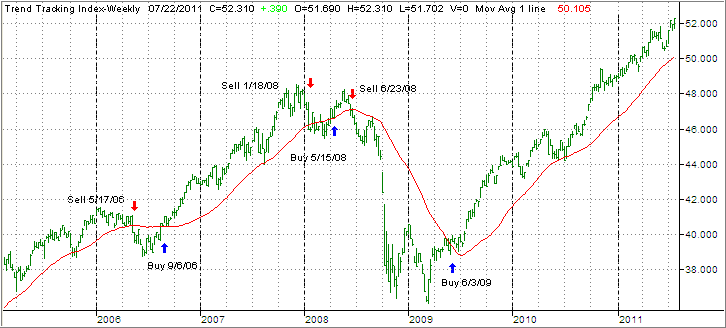

Following the rebound, our Trend Tracking Indexes (TTIs), moved back further into bullish territory by the following percentages:

Domestic TTI: +4.70% (last week +3.82%)

International TTI: +0.91% (last week -1.28%)

As you can see, the International TTI has now crawled back out of the basement and has crossed its trend line to the upside—again. We just finished doing this dance, as this indicator has no clear direction and has bounced slightly below and above this dividing line between bullish and bearish territory in the recent past.

We successfully avoided the last potential whipsaw signal and will try to go for a ‘two-peat.’ What that means is that, despite this move above the line, I will wait for a few trading days to see if this is just another head fake or the real thing before issuing a new ‘Buy’ for that arena. This is the time to be patient.

Next week, we’ll be facing a host of economic reports including Consumer Confidence, New Home Sales, Durable Orders and GDP, just to name a few. Earnings season will pick up speed, and I am sure, the European debt crisis will present us with new varieties of how to kick the can down the road and not face realities head on.

It promises to be another interesting week. As always, be sure to have your exit strategy in place, so you don’t stress when the heat is on.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Leslie:

Q: Ulli: Is there an easy way to reach your updated TTIs and your associated comments? Since the change in your blog, I can no longer easily find them.

A: Leslie: Nothing has changed other than the format of my blog. The weekly StatSheet is still being published every Thursday, and the Market commentary and StatSheet info are being mailed out every Friday.

If you like to access the latest version directly, go to www.TheETFBully.com, look for the heading “ETF Newsletter” on the black ribbon in the header and select “Latest Newsletter.” That will give you easy access to the latest StatSheet.

Hope that helps.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

The Street featured an article titled “Simple Ideas for Downside Portfolio Protection.”

The Street featured an article titled “Simple Ideas for Downside Portfolio Protection.”