Life after the completion of the endless debt ceiling debate proved to be a challenge for Wall Street, as finally the economic reality sank in that all is not well with the alleged 2nd half recovery.

Life after the completion of the endless debt ceiling debate proved to be a challenge for Wall Street, as finally the economic reality sank in that all is not well with the alleged 2nd half recovery.

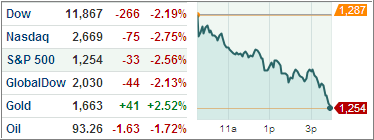

With today’s sharp selloff, serious technical damage was done, as widely watched major trend lines were violated, which could invite more selling. Especially disheartening was the fact that we closed at the lows of the day, as the chart above (courtesy of MarketWatch.com) clearly shows.

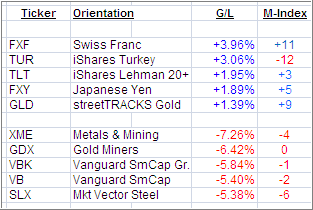

Here are some of the widely followed indexes and the percentages by which they have moved below the line and into bear market territory: