ETF/Mutual Fund Data updated through Thursday, August 11, 2011

If you are not familiar with some of the terminology used, please see the Glossary of Terms.

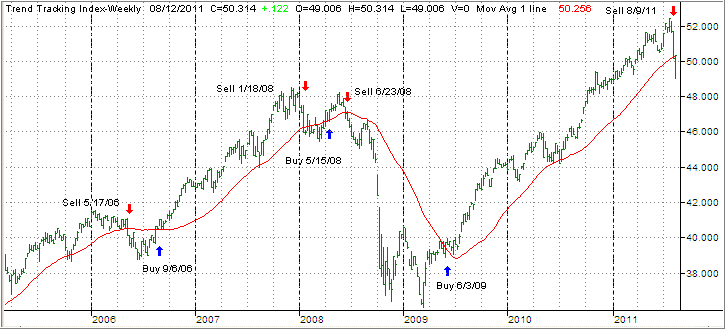

1. DOMESTIC EQUITY MUTUAL FUNDS/ETFs: SELL — since 8/9/2011

This past week, the domestic TTI broke through its long-term trend line generating a Sell for this area effective 8/9/2011. Over the past few days, we’ve seen the TTI hovering slightly below and above this dividing line between bullish and bearish territory. I will not issue a new Buy signal until this index has clearly pierced the trend line to the upside and has remained there for a few trading days.

As of today, our Trend Tracking Index (TTI—green line in above chart) has broken above its long term trend line (red) by +0.19%.