- Moving the markets

A variety of events combined forces to pull the markets out of their doldrums, while not only creating a new “Buy” signal for our Trend Tracking Indexes (section 3) but also breaking the S&P 500’s glass ceiling, namely its 200-day M/A (+0.57%).

We also were re-acquainted with the fact that bad news is good news, as poor economic data releases were seen as putting pressure on the Fed regarding their hawkish interest rate policy.

As ZeroHedge pointed out, Job Openings fell by 353k, as hiring, quits tumbled to multi-year lows. US Pending Home Sales plunged to their biggest annual drop ever, and the Chicago PMI collapsed to Covid-lockdown lows.

But the big assist came from the Fed, when Powell presented his prepared remarks, while talking out of both sides of his mouth:

Dovish:

- The time for moderating the pace of rate increases may come as soon as the December meeting.

Hawkish:

- FED WILL NEED RESTRICTIVE POLICY FOR `SOME TIME’

- RATE PEAK LIKELY `SOMEWHAT HIGHER’ THAN SEPT. FORECASTS

- “Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level.”

- CONSIDERABLE UNCERTAINTY OVER WHERE RATES WILL PEAK

- WILL REQUIRE SUSTAINED PERIOD OF SLOWER DEMAND GROWTH. It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high.”

- HISTORY CAUTIONS AGAINST PREMATURELY LOOSENING POLICY

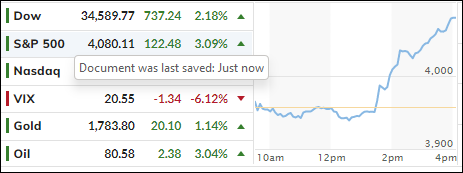

There you have it. The caution that higher rates are here to stay far outweighed his lonely dovish comment. However, the latter was all the markets wanted to hear, and off to the races we went with the Dow scoring a 700-point gain, the S&P 500 storming ahead +3.09%, all of which now looks to be the beginning of the much hoped for Santa Claus rally.

Once the bulls got the upper hand, it comes as no surprise that shorts were squeezed adding to the late session Ramp-A-Thon. Bond yields dropped sharply, the US Dollar got slammed, while gold was the beneficiary with the precious metal spiking +1.14% and having its best month since July 2020.

Back to the 2008-2009 analog. Have we now reached a point where 2022 will diverge and start a new bull market?

We will soon find out.

2. “Buy” cycle suggestions

For the current Buy cycle, which starts on 12/1/2022, I suggest you reference my most recent StatSheet for ETFs selections. If you come on board later, you may want to look at the most current version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs finally broke out of their trading ranges with both generating a new Buy signal effective tomorrow, 12/1/2022. The Domestic TTI covers “broadly diversified domestic mutual funds and ETFs,” while the International one contains the same but in the international arena.

This is how we closed 11/30/2022:

Domestic TTI: +4.16% above its M/A (prior close +1.72%)—Buy signal effective 12/1/2022.

International TTI: +3.31% above its M/A (prior close +1.47%)—Buy signal effective 12/1/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli