Last week’s rally attempt in anticipation of a super jobs report ran into resistance as the horrific unemployment numbers had Wall Street traders trying to put some lipstick on that pig. The ensuing sell off was modest at best, and the major indexes ended up gaining slightly for the week.

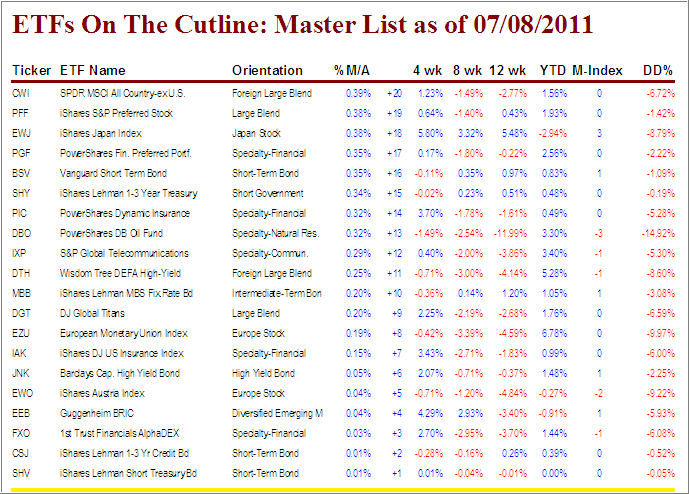

Trend direction was predominantly sideways, which means not much happened around the cutline. High Yield Bonds (JNK) recovered from a -6 position and rallied to +6. The Diversified Emerging Markets (EEB) rose from the basement, below the -20 position, and ended up at +4.

As I pointed out last week, if you are following some of the better performing ETFs, which have moved above the +20 position, you need to track them now via the Master ETF list. You can find the latest version in last Friday’s StatSheet (section 3).

I realize that this is a bit of a hassle, and I am working on having the Cutline reports improved by not only showing the +20 positions above the line, but to expand that to +100. That will enable you to view and track those ETFs that have previously crossed the line to the upside and are now showing improvements in the various momentum columns.

This should make the Cutline reports a far better tool for you to track your selected ETFs quickly and effectively. My programmer is working on these changes, and I hope to have them completed within 2 weeks.

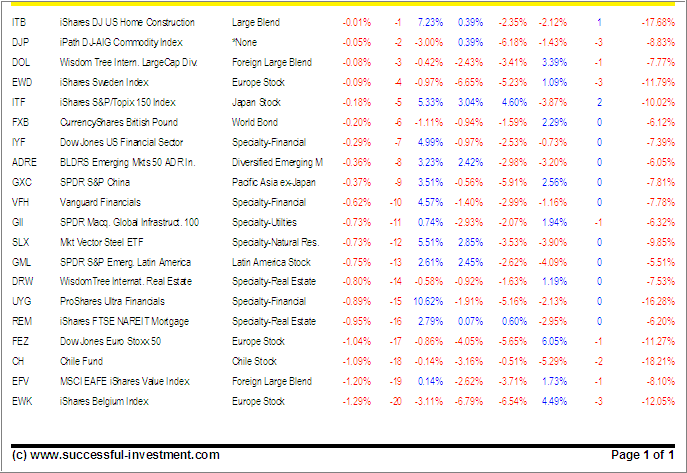

Take a look at this week’s report:

[Click on tables to enlarge, copy and print]

Despite the recent rally, one country has not participated, and that is China via the heavyweight GXC ETF. While it only remains below the trend line by a meager -0.37% in the -9 position, it’s DrawDown of -7.81% makes GXC a laggard.

Fundamental news out of China, including inflations numbers and the potential property bubble, point to an ETF that I simply consider one hot potato that should be held at this time.

Reference: “How do I use the ETF Cutline Table to make a Buy decision”

Previous posts:

ETF Cutline Post as of 7/1/2011

ETF Cutline Post as of 6/24/2011

ETF Cutline Post as of 6/17/2011

ETF Cutline Post as of 6/10/2011

ETF Cutline Post as of 6/3/2011

ETF Cutline Post as of 5/27/2011

ETF Cutline Post as of 5/20/2011

ETF Cutline Post as of 5/13/2011

ETF Cutline Post as of 5/6/2011

ETF Cutline Post as of 4/29/2011

ETF Cutline Post as of 4/21/2011

ETF Cutline Post as of 4/15/2011

ETF Cutline Post as of 4/8/2011

ETF Cutline Post as of 4/4/2011

Disclosure: No holdings

Contact Ulli

Comments 2

I HOPE YOU MEANT TO SAY SHOULD NOT HOLD RE: GXC

Yes, Irv; that’s what I intended to say.

Ulli…